what is health care fsa coverage

To carryover your unspent funds. HSAs are referred to as providing triple tax savings.

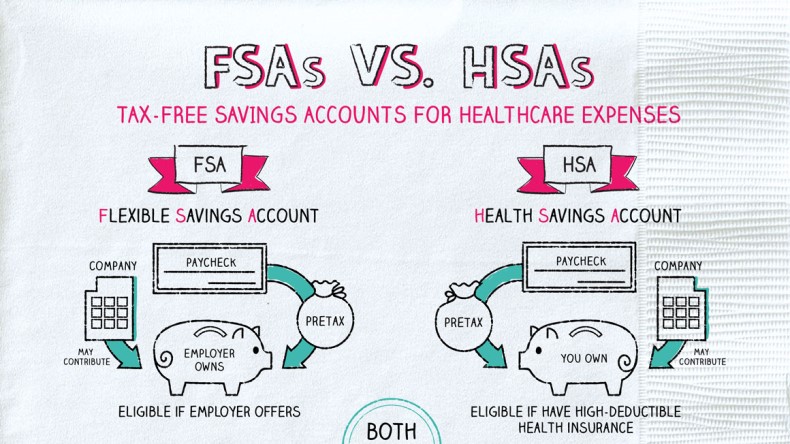

What Are Fsas Vs Hsas Napkin Finance

Lets jump into HCFSA 101 to discover how you can begin saving thousands.

. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or. These accounts use pre-tax money from your paycheck that you can use to pay for medical. The promotional codes OPTFSA7 OPTHSA5 and OPTHRA7 offered by the Optum Store is intended for the sole use by Optum Financial flexible.

You can use your FSA to cover eligible health care expenses early in the year as long as you plan to contribute whats necessary to cover those expenses by the years end. Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses. The CARES Act of 2020 added feminine hygiene products to the list of those covered by your FSA.

You must enroll in either the Limited Purpose FSA or Medical FSA for the following year or. 7 This means that you can now use FSA money to buy pads tampons. You will not be able to incur new expenses during this period unless you are eligible for and elect COBRA.

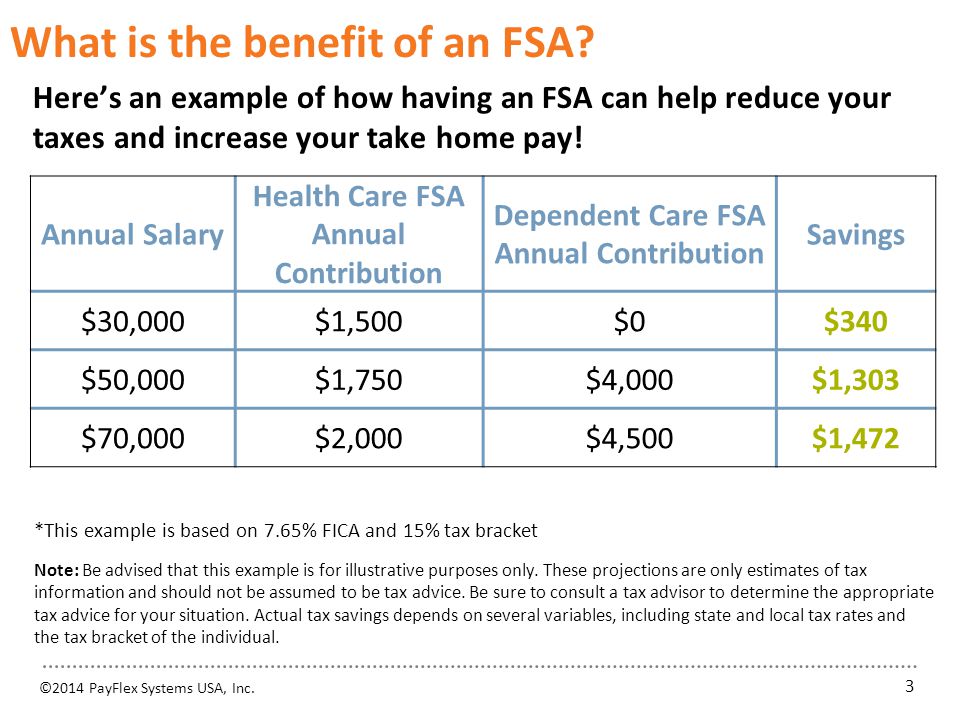

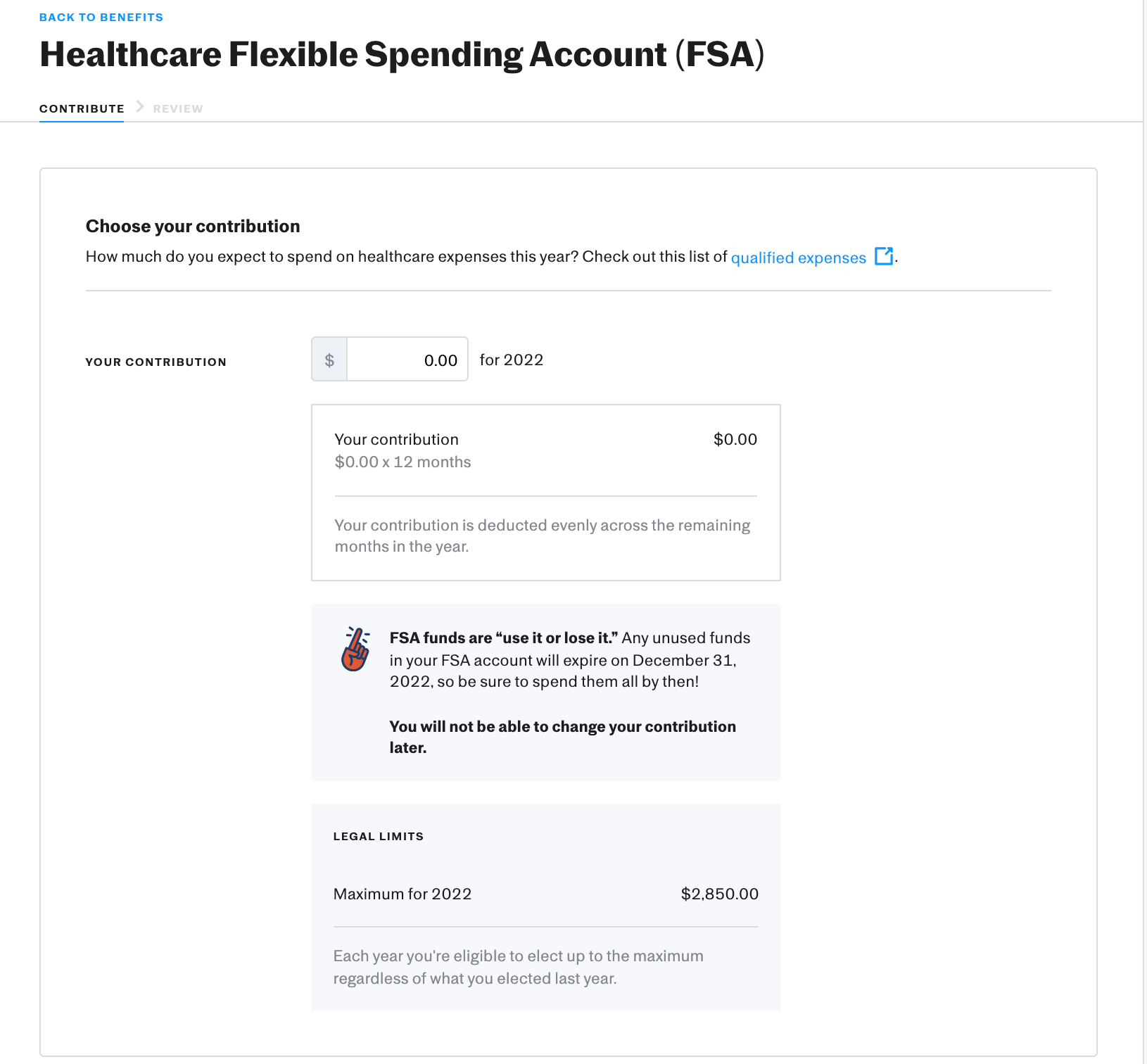

Check your plan for specific coverage details. Employees in 2023 can contribute up to 3050 to their health care flexible spending accounts FSAs pretax through payroll deductiona 200 increase from 2022the. The Savings Power of This FSA.

A Flexible Spending Account FSA has benefits you want to pay attention to. 16 rows You can use your Health Care FSA HC FSA funds to pay for a wide variety of health care products and services for you your spouse and your dependents. Tax-free interest or other earnings on the money in the account.

An HCFSA is a spending account for eligible healthcare expenses. A health savings account HSA offers the opportunity to build a stash of cash that can help you pay medical expenses for years or even decades. Shop for your own coverage Medical Dental Other Supplemental Plans through your employer.

You can spend FSA funds to pay deductibles. Have at least 120 left in your FSA balance. COBRA or the Consolidated Omnibus Budget Reconciliation Act lets you continue.

You can use funds in your FSA to pay for certain medical and dental expenses for you your spouse if youre married and your dependents. Learn about the medical dental pharmacy behavioral and voluntary benefits your employer. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere.

Unused funds up to. Use your account instantly. But not everybody is eligible for.

But not everyone has access to one. Health Care FSA A health care FSA helps you pay for eligible out-of-pocket medical dental vision hearing and prescription drug expenses for you your spouse and your tax dependents. NCFlex Convenience Card works like a credit card or debit card when paying for these.

Dependent Care Flexible Spending Account FSA. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. Set aside Pre-Tax dollars to use for eligible health care expenses.

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Flexible Spending Accounts Uk Human Resources

Benefits Guidebook January 1 December 31 2020 By Wfu Talent Issuu

Hra Vs Fsa See The Benefits Of Each Wex Inc

Flexible Spending Accounts Fsa Isolved Benefit Services

Flexible Spending Account Benefits For Employers Kbi Benefits

Health Care Fsa Eligible Expenses University Human Resources The University Of Iowa

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Health Fsa Flexible Spending Arrangement Plan Documents 129core Documents

Flexible Spending Accounts Fsa State Employee Health Plan

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

New Eligible Expenses For Your Health Care Fsa Hub

Comparing Tax Favored Hsa Hra Fsa Medical Options Don T Mess With Taxes

Flexible Spending Accounts Healthcare Fsa Dependent Care Fsa Justworks Help Center

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Flexible Spending Accounts Fsa Vs Health Savings Accounts Hsa